The Origins of the Stock Market

The stock market, as we understand it today, is a sophisticated and essential component of the global financial landscape. It provides a platform for companies to raise capital and for investors to purchase ownership stakes in firms. While the comprehensive mechanisms of modern stock exchanges are relatively recent, the foundational idea of trading goods and ownership dates back thousands of years. This exploration offers a detailed account of the evolution of the stock market, detailing its inception, growth, and the various technological advancements that have shaped it through the centuries.

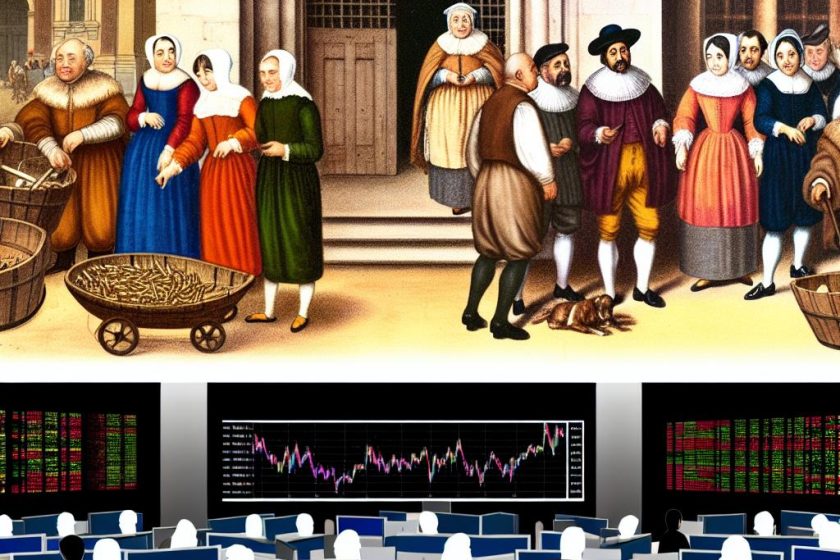

The Birth of Modern Stock Exchange

During the 1600s, the financial mechanisms that began to define modern stock exchanges were pioneered. The establishment of the Dutch East India Company in 1602 marked a significant milestone. This company was one of the first to issue shares of stock to the public. The public’s ability to own a part of a company in the form of stocks was revolutionary. This innovation established the Amsterdam Stock Exchange, recognized as the world’s initial official stock exchange. This development provided a structured environment for investors to engage in the trade of shares, setting a precedent for organized capital markets globally.

Discussing the Amsterdam Stock Exchange, it essentially laid the foundational framework for modern financial markets. The introduction of an organized exchange enabled a wide range of economic activities. Investors had the opportunity to diversify their holdings, businesses could accelerate growth through equity capital, and the general public could participate in the economic outcomes of businesses.

Expansion and Evolution

The concept did not remain isolated in Amsterdam; instead, it sparked interest and eventually led to the emergence of other financial hubs. One of the critical developments occurred in England, where the London Stock Exchange was formally established towards the end of the 17th century. However, the roots of London’s financial trading activities stretch back to 1571, when informal trading began. Traders, merchants, and investors, recognizing the benefits of organized trading, contributed to the development of one of the world’s most renowned stock exchanges.

On the other side of the Atlantic, financial activities began to take formal shape with the signing of the Buttonwood Agreement in 1792. Here, a group of financiers convened under a buttonwood tree to lay the foundations of what would become the New York Stock Exchange (NYSE). The NYSE is testament to the enduring principles of trust and collaboration that underline financial markets, evolving to become a world leader in stock exchanges.

The Impact of Technology

The evolution of technology has played an integral role in the transformation of the stock market, particularly in the 20th and 21st centuries. Initially, information dissemination and transaction execution were hampered by the slower communication methods of the day. However, the invention of the telegraph revolutionized this dynamic. It allowed for quicker communication of stock prices and market conditions across distances, laying the groundwork for rapid transactions.

Later advancements like stock tickers, which reported the latest prices, further sped up the trading process. As computer technology advanced, it wasn’t long before the stock market recognized its potential. Computers shortened the information processing time considerably and paved the way for high-frequency trading.

In more recent years, electronic trading platforms became available, bringing profound changes to the market. Such platforms allow investors to execute trades from anywhere at any time, effectively decentralizing trading floors. Individuals now have unprecedented access to stock trading, leveling the playing field and expanding participation opportunities. As a result, the stock market experienced an increase in both transaction speed and trading volumes, reflecting a much wider global reach.

The Global Perspective

Today, stock exchanges operate as a global network, influencing economies worldwide. The economic activities enabled by these platforms are integral to modern society, facilitating the trade of trillions of dollars each day. Major stock exchanges like the NYSE, NASDAQ in the United States, the London Stock Exchange in Europe, and various others across Asia, including the Hong Kong Stock Exchange and the Bombay Stock Exchange, play pivotal roles in their respective regions.

These exchanges not only support local economies but also reflect global economic activities and trends. Their interconnectivity means that economic shifts in one region can have ripple effects across the globe, signaling the highly integrated nature of today’s financial markets.

By tracing its development, we can see how the stock market has adapted and transformed as societal needs and technological capacities have evolved. Its history tells a tale of entrepreneurial foresight, incremental innovations, and tactical adaptation, all contributing to the intricate financial systems with which we are familiar today.

The journey from simple trade agreements in ancient Mesopotamia to the contemporary powerhouse of global commerce underscores the adaptability and innovation inherent in financial systems. As technology continuously advances, the stock market remains poised to unlock new opportunities, ensuring its critical role in economic prosperity and development remains steady.

This article was last updated on: March 17, 2025